Freehold vs. Leasehold in Dubai: Understanding Your Property Options

Introduction

Dubai's real estate market is known for its vibrant opportunities and diverse property types. Among the key factors influencing property ownership in the city are the terms "freehold" and "leasehold." Understanding these concepts is crucial for both investors and homebuyers as they navigate the competitive landscape of Dubai's real estate.

In this article, we will explore the differences between freehold vs. leasehold properties, their benefits and drawbacks, and how to choose the right option for your needs.

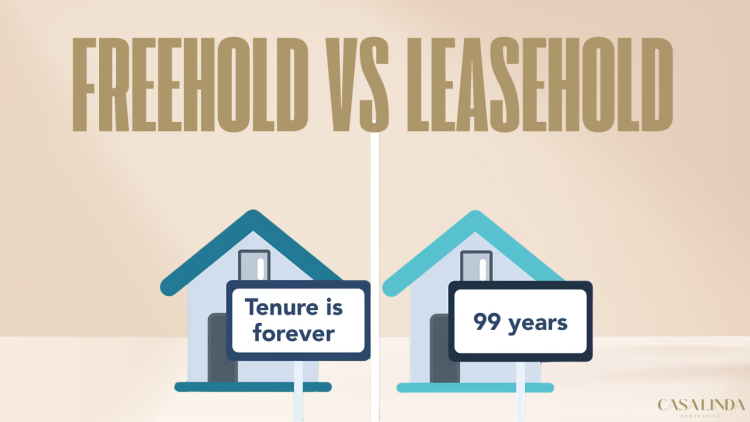

What is Freehold Property?

Freehold property grants the owner complete ownership of the land and the building on it. This type of ownership allows for full rights to use, sell, or lease the property as the owner sees fit.

In Dubai, freehold properties are primarily available to foreign investors in designated areas, making them an attractive option for expatriates looking to secure long-term investments.

Benefits of Freehold Properties

Full Ownership: Owners have complete control over their property and can make alterations as desired.

Long-term Investment: Freehold properties typically appreciate over time, making them ideal for long-term investors.

- Ease of Sale: Selling freehold properties can be easier due to the high demand among buyers seeking permanent ownership.

Drawbacks of Freehold Properties

Higher Initial Costs: The purchase price of freehold properties can be significantly higher than leasehold options.

- Ongoing Maintenance: Owners are responsible for the upkeep and maintenance of their property, which can lead to additional costs.

What is Leasehold Property?

Leasehold property allows individuals to purchase the right to occupy and use a property for a specified period, typically up to 99 years. In this arrangement, the land itself remains owned by the landowner (the lessor).

Leaseholders have the right to live in, rent out, or sell the property during the lease term, but they do not own the land.

This type of ownership is common in Dubai and can provide a more affordable entry point into the real estate market while still offering opportunities for rental income and investment.

Benefits of Leasehold Properties

Lower Purchase Price: Leasehold properties often have lower entry costs, making them accessible to a broader range of buyers.

Less Responsibility: Leaseholders are typically not responsible for the land, meaning they may have fewer long-term maintenance concerns.

- Potential for Rental Income: Leasehold properties can be a good investment for generating rental income, especially in high-demand areas.

Drawbacks of Leasehold Properties

Limited Control: Leaseholders have limited rights regarding alterations and must adhere to the terms set by the lessor.

Expiry of Lease: At the end of the lease period, the property reverts to the landowner, which can complicate long-term investment plans.

Potential for Lease Renewals: While lease renewals are common, they are not guaranteed, and costs may increase.

Key Considerations When Choosing Between Freehold and Leasehold

Investment Goals: Consider your long-term objectives. If you seek permanent ownership and control, freehold may be the better choice. Conversely, if you want a more affordable entry point or shorter commitment, a leasehold might suit your needs.

Financial Implications: Analyze your budget and the associated costs of both ownership types. Remember to factor in maintenance, potential property appreciation, and the implications of lease expirations.

Lifestyle Needs: Your lifestyle preferences will play a significant role in your decision. Freehold properties offer more freedom, while leasehold options may provide less responsibility.

Location: Research areas in Dubai that offer freehold and leasehold options. Popular neighborhoods for Freehold areas in Dubai include Dubai Marina, Palm Jumeirah, and Downtown Dubai.

Leasehold properties are often found in established areas such as Jumeirah and Deira, which may offer more affordable options.

Conclusion

Choosing between freehold and leasehold properties in Dubai requires careful consideration of your financial goals, lifestyle preferences, and long-term plans. Each ownership type has its distinct advantages and challenges.

By understanding the differences in freehold vs. leasehold properties, you can make an informed decision that aligns with your investment strategy. As Dubai's real estate market evolves, staying informed about ownership options will help you navigate this dynamic landscape successfully.

FAQ

1. Does Dubai have both freehold and leasehold properties?

Yes, Dubai features both freehold and leasehold options. Foreigners can buy freehold properties in designated areas, while leasehold properties are widely available.

2. Which is better: freehold or leasehold?

It depends on your individual needs and investment goals. Freehold properties provide full ownership and control, while leasehold options might be more budget-friendly but come with certain limitations.

3. What are the advantages of leasehold properties?

Leasehold properties often have lower initial costs and can provide rental income, making them appealing to those looking for immediate returns.

4. Are freehold properties more expensive than leasehold properties?

Generally, yes. Freehold properties tend to have a higher purchase price due to complete ownership rights.

5. What happens when my 99-year lease ends in Dubai?

Upon expiration of the leasehold, the property typically reverts to the landowner unless a renewal agreement is negotiated.

6. Can I sell my leasehold property?

Yes, you can sell your leasehold property during the lease term, although the sale is subject to the conditions laid out in the lease agreement.

7. Can I rent out my freehold property?

Absolutely! Freehold property owners can lease or rent their properties without any restrictions.

8. What should I consider when choosing between freehold and leasehold?

Consider your financial situation, investment goals, desired level of ownership, and the specific terms associated with each property type.

9. What steps are involved in buying freehold property in Dubai?

The process includes selecting a property, conducting thorough research, obtaining financing (if necessary), and completing the legal formalities, including registration with the Dubai Land Department.

By understanding the variances of freehold vs. leasehold ownership, you can make a well-informed decision and invest wisely in Dubai’s thriving real estate market. For more insights or personalized assistance, feel free to reach out to Casalinda Properties.